It’s time for me to share a counter-intuitive truth regarding progressive taxation. It makes sense to the French, but it will surprise libertarians/neo-conservatives. I figured it out in my junior year at the university when I took finance, and was looking over tax rates and accounting. It’s been an issue that’s been close to my heart for a long time…

Problem: How do we solve income inequality without significantly impairing productivity?

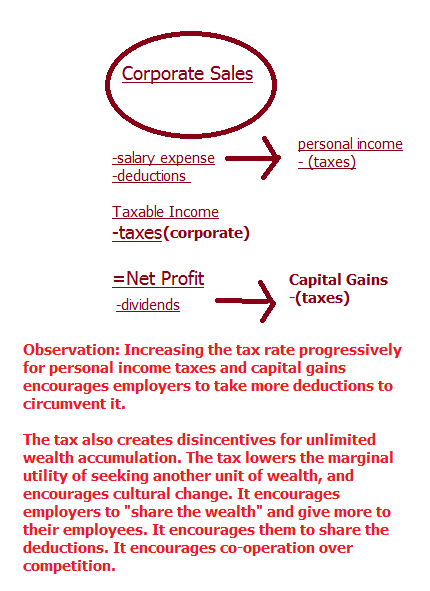

Solution: When you raise taxes for the upper class, they are more likely to reinvest it in their employees because higher tax brackets would mean they would lose the new amount to taxation anyway. (By taxes, I mean capital gains, personal income, or inheritance taxes.)

Explanation: There are all kinds of deductions for sole proprietorships and corporations. You can have a deduction for a company car, or office equipment. You can list entertainment as an expense. Both reduce your tax burden regardless of the tax rate.

The only time money comes in is 1) when your company pays a dividend 2) when you give yourself a salary 3) when you sell stocks.

Premise: Progressive taxes lowers the marginal utility of having exploitation for the upper class. It becomes more useful to become a “great man” and offer alms to your employee, and boost your ego in that way. Currently, materialism encourages people to enrich themselves and conspicuously display their wealth to boost one’s ego.

Caveat – if you’re working for an asshole, he might still exploit his employees to the max, even if it put him in a higher tax bracket. But he would receive less benefit, than if he put the money into improving his working environment.

Caveat 2 – An asshole might use the deductions mainly to his own benefit, i.e. improving his office over the employees.

But at least 1) the record makes it more transparent 2) the board of directors can investigate to the extent they control the company 3) abuse can open the company up to tax fraud, or government intervention

Premise 2: Empowering lower level employees is useful. Reducing income inequality makes more people work harder. Shifting the company culture to make people work toward a unified goal rather than simply enriching themselves is usually possible. Such a shift works better than giving your “stars” whatever they ask for, and trusting the pareto principle.

Premise 3: Company cultures are moldable, and people can be motivated by loyalty rather than simply power/money/status they can lord over other coworkers or at home. A degree of cooperation and sharing is possible without full communism.